Coronavirus Job Retention Scheme (CJRS) in the UK

These instructions were updated on the 21st July 2020

As part of the UK Governments support for businesses during the COVID-19 pandemic, the Coronavirus Job Retention Scheme (CJRS) went live in the UK on the 20th April 2020.

Information on how to claim can be found on the HMRC website here.

As an employer it is your responsibility to understand the calculations and obligations under this scheme, failure to report accurately will have an impact on the timeliness and value of your claim.

We are currently developing reporting capabilities to assist with the calculation and submission of your claim.

Under 100 furloughed employees must be entered manually

HMRC have set a threshold of 100 furloughed employees before you can upload a file, employers with less than this will need to enter details manually to the portal.

To learn how to make a claim and login to the Coronavirus Job Retention Scheme portal you can follow this link.

Calculating Furlough Amount Per Period

Infinet Cloud Payroll does not support auto-calculation of the rate to be paid to employees whilst on CJRS, HMRC Guidance can be found here.

Where you are calculating for an employee on "Salary", please multiply the frequency to get an Annual figure (i.e. multiply the monthly rate by 12, weekly rate by 52, etc.).

When you are calculating for an employee on "Wages", please calculate the rate "per hour" in line with their Leave Request Working Week.

If you fall outside of the two scenarios above, please contact support@infinetcloud.com

To ensure that Employee pay is correctly pulled in to the CJRS reporting there must be a Salary/Wages Pay Component of the requisite type on the employee record, which is current.

This can only be 80% or 100%

Infinet Cloud CJRS Reporting supports claims that are either calculated as 80% by the Employer, or at topped up to 100% by the Employer (and the report will claim 80% of that figure). If you are topping up to some other variable you must create the Salary/Wages as 100% and adjust manually

Calculating Furlough Hours Per Day

You will need to calculate the number of furlough hours per day - please review the government guidance on this here.

Creating a Pay Component for Furlough

Prior to setting up the pay component you need to ensure your employees are set up on their contractual Leave Request Working Week (e.g. 40 hours total, 5 days a week, 8 hours a day)

On the employee's record edit the existing Furlough Pay Component or create a new Pay Component as indicated below depending on whether they are Salary (Base Salary) or Wages (Normal Time):

1. Pay Component Sub Type | Base Salary | Normal Time |

|---|---|---|

2. Description | Auto-sources | |

| 3. UOM | Year | Hour |

| 4. Frequency | Auto-sources from the employee's record | |

| 5. P&L Account | As appropriate | |

| 6. Quantity | 1 | Number of hours per week/fortnight |

| 7. Rate | 100% of contractual annual salary | 100% of contractual hourly rate |

| 8. Amount & Amount Per Period | Auto-populates with the employee's standard contractual pay per period | |

| 9. Start Date | Must be the first day of the employee's period of Furlough | |

10. Current | True | |

| 11. Is Furlough | True - if this pay component relates to a period of Furlough | |

| 12. Furlough Amount Per Period | This needs to be completed if "Is Furlough" is ticked. This is the amount to be paid to the employee during each pay period whilst on Furlough. This overrides the contractual amount as set in step 7. | |

| 13. Is Topped Up | True - if you are topping up to 100% and the figure entered in step 12 is 100% of contractual pay - the CJRS report will only give figures to claim 80%. | |

| 14. Furlough Hours Per Day | Enter the Furlough Hours per Day as worked out using the guidance here. You must use as many decimal places as possible e.g. 40 hours per week, 40/7 = 5.7142857142857. This must be a minimum of 6 decimal places. The system will round the working week to the nearest whole hour e.g. 37.5 hours will round to 38 hours. | |

To calculate the number of usual hours for each pay period (or partial pay period):

Start with the hours your employee was contracted for at the end of the last pay period ending on or before 19 March 2020.

Divide by the number of calendar days in the repeating working pattern, including non-working days.

Multiply by the number of calendar days in the pay period (or partial pay period) you are claiming for.

Round up or down if the result isn’t a whole number.

This is how the system calculates hours in the week/month of furlough to calculate the hourly rate for furlough in that week/month.

Once done, click Save.

Use the Field Help to assist with completion of the UK section of the pay component above

Annual Leave Reference Rate

Any annual leave (including public holiday) within the period will be treated as furloughed (so the CJRS report will try to claim 80% of it).

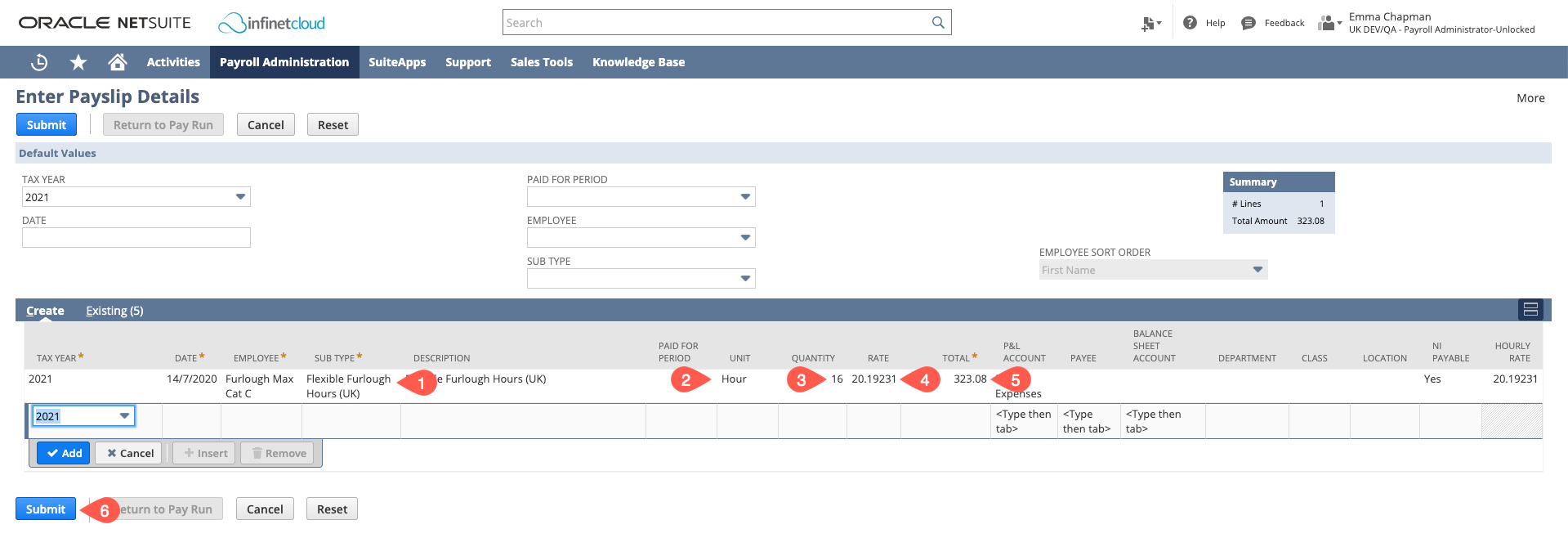

Flexible Furlough

To pay the worked days where the employee is being paid on a “flexible furlough” basis you will use the Enter one-off pay details function - click here for full instruction on how to Enter One Off Pay Details in Advance.

Only do this after you have set up the Furlough pay component.

- Sub Type is Flexible Furlough Hours (UK)

- Unit is Hours

- Quantity is the number of hours they worked

- Rate will auto-populate with the normal hourly rate

- Amount will populate from Quantity x Rate - this is the total being paid

- Continue to do this for employees as required. Once all lines have been added - click Submit

When the payslip is processed, the furlough amount as set up in the Furlough Pay Component, will be reduced by the furlough hourly rate (Furlough amount per period / hours in period) x number of Flexible Furlough Hours

Returning from Furlough

If an employee is permanently returning from furlough you will need to create a pay component as normal with their full salary. Do NOT tick “is furlough” on the new pay component and do NOT continue to use the Furlough pay component by editing and unticking "Is Furlough".

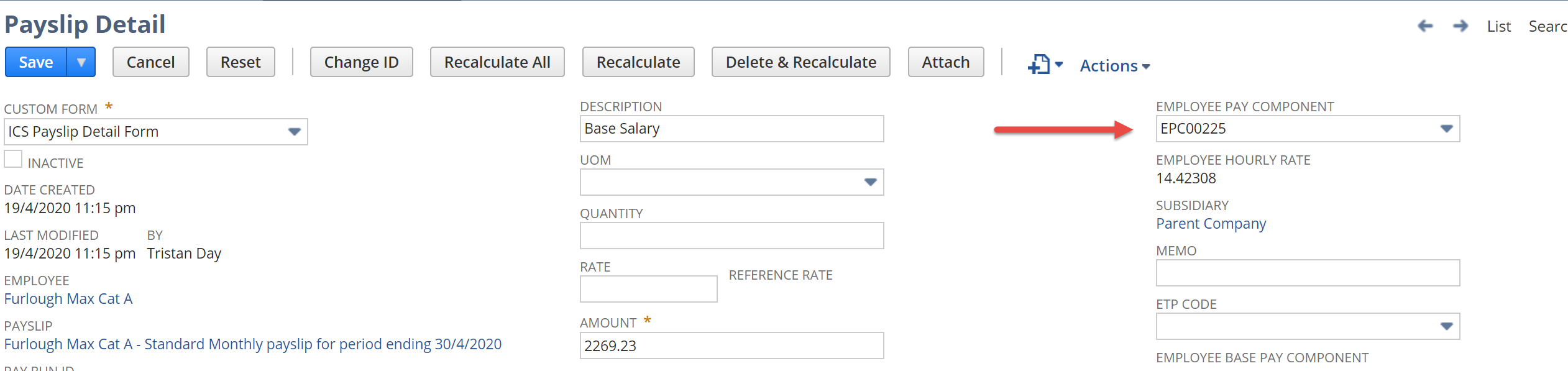

Payslip Details

If you need to attach Payslip Details that have already been created it doesn't matter if they are different values (as some weekly staff, for example, will have different rates each week) then they need to be attached to the Pay Component via the "Employee Pay Component" field.

Do not Trigger Scripts and Workflows if doing by CSV

If you do this via CSV Import you must NOT trigger scripts and workflows as this may cause sourcing issues. ALWAYS download the records you are updating as a backup BEFORE performing the update.

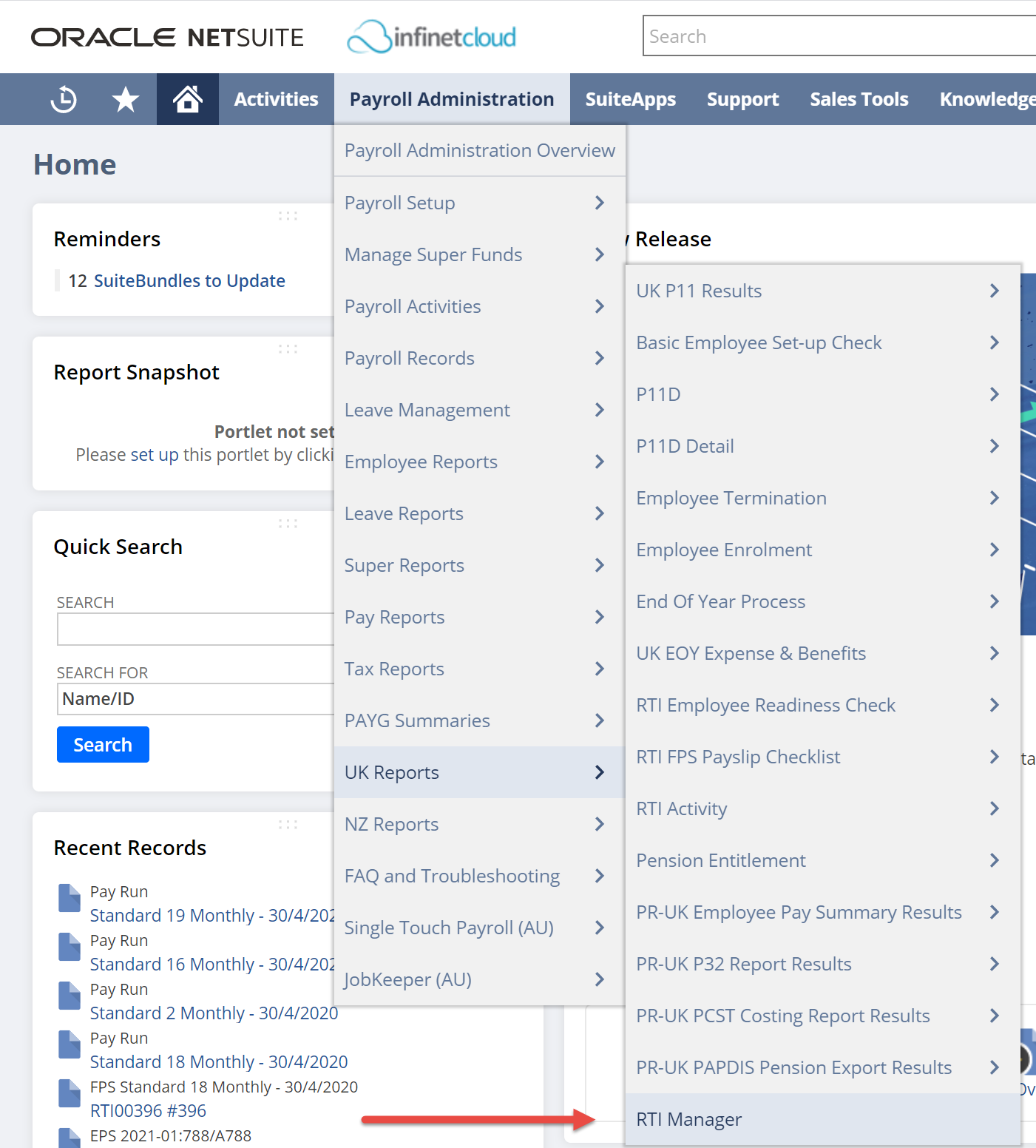

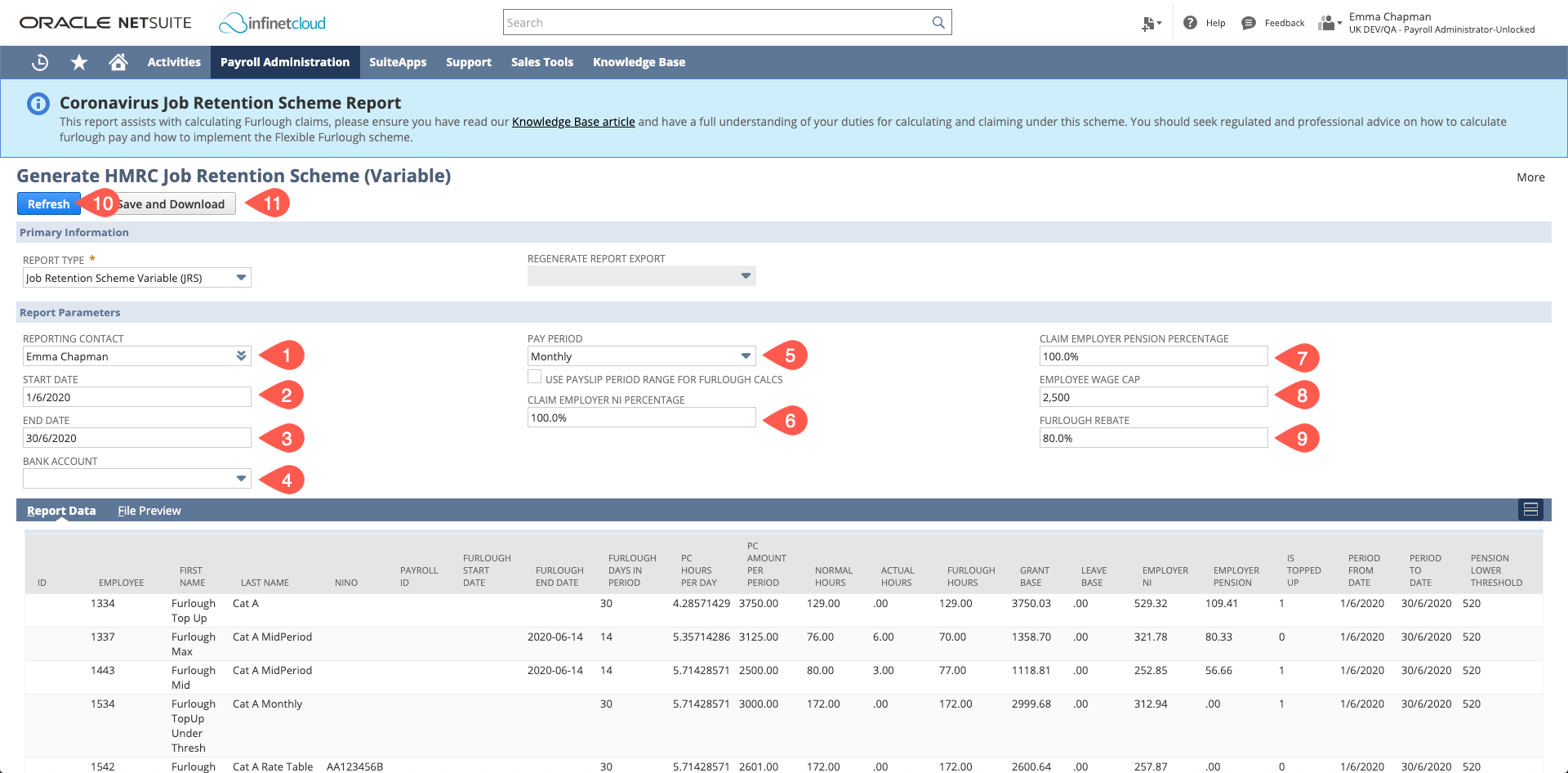

To review a report which can be used to enter information in to the CJRS portal (< 100 employees) or that can be uploaded (>100 employees) you can go to Payroll Administration > UK Reports > RTI Manager

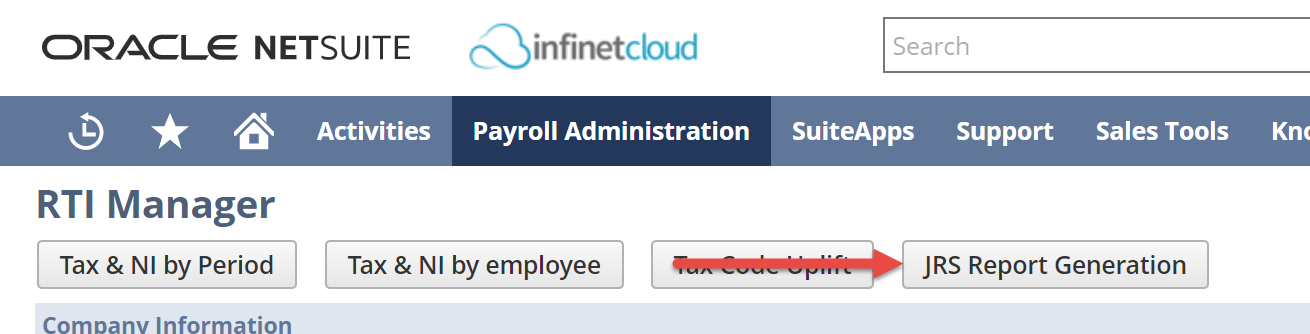

Click "JRS Report Generation"

The header information will be presented in the download for entry or used in the query as follows:

- Reporting contact

- Start Date

End Date

Do one download per pay period and consolidate them externally

For the most accurate, reconcilable results we recommend running the report once for each pay period

- Bank Account - the account that will be receiving the claim money

Pay Period (if you pay in arrears, the date range must include the pay date and you should tick "Use Payslip Period Range for Furlough Calcs")

You can only report in a single frequency per download

Due to period date restrictions the generator can only be run one frequency at a time, so if you have weekly and monthly frequencies please download them separately. You should consolidate them externally if necessary.

You are able to manually edit the below fields (6-9) so that you can manipulate the report in line with the tapering of the grant employers can claim through the scheme from August 2020 onwards.

- Set the percentage of Employer NI you are claiming in this report

- Set the percentage of the Employer Pension contribution you are claiming in this report

- Set the Wage Cap for the report

- Set the Furlough Rebate

- Once completed click Refresh and review

- Save and Download

Enter or upload your data to the Coronavirus Job Retention Scheme

End.

Stay Healthy.